Renters Insurance in and around Midlothian

Midlothian renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Richmond

- Glen Allen

- Moseley

- Chesterfield

- Woodlake

- Brandermill

- Skinquarter

- Magnolia Green

- Hallsley

- Virginia

- Chester

- Amelia

- Powhatan

- Goochland

Protecting What You Own In Your Rental Home

There's a lot to think about when it comes to renting a home - price, size, location, townhome or house? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Midlothian renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

There's No Place Like Home

When the unpredicted break-in happens to your rented apartment or home, often it affects your personal belongings, such as a laptop, a tool set or a TV. That's where your renters insurance comes in. State Farm agent Cindy Shumaker wants to help you examine your needs so that you can protect your belongings.

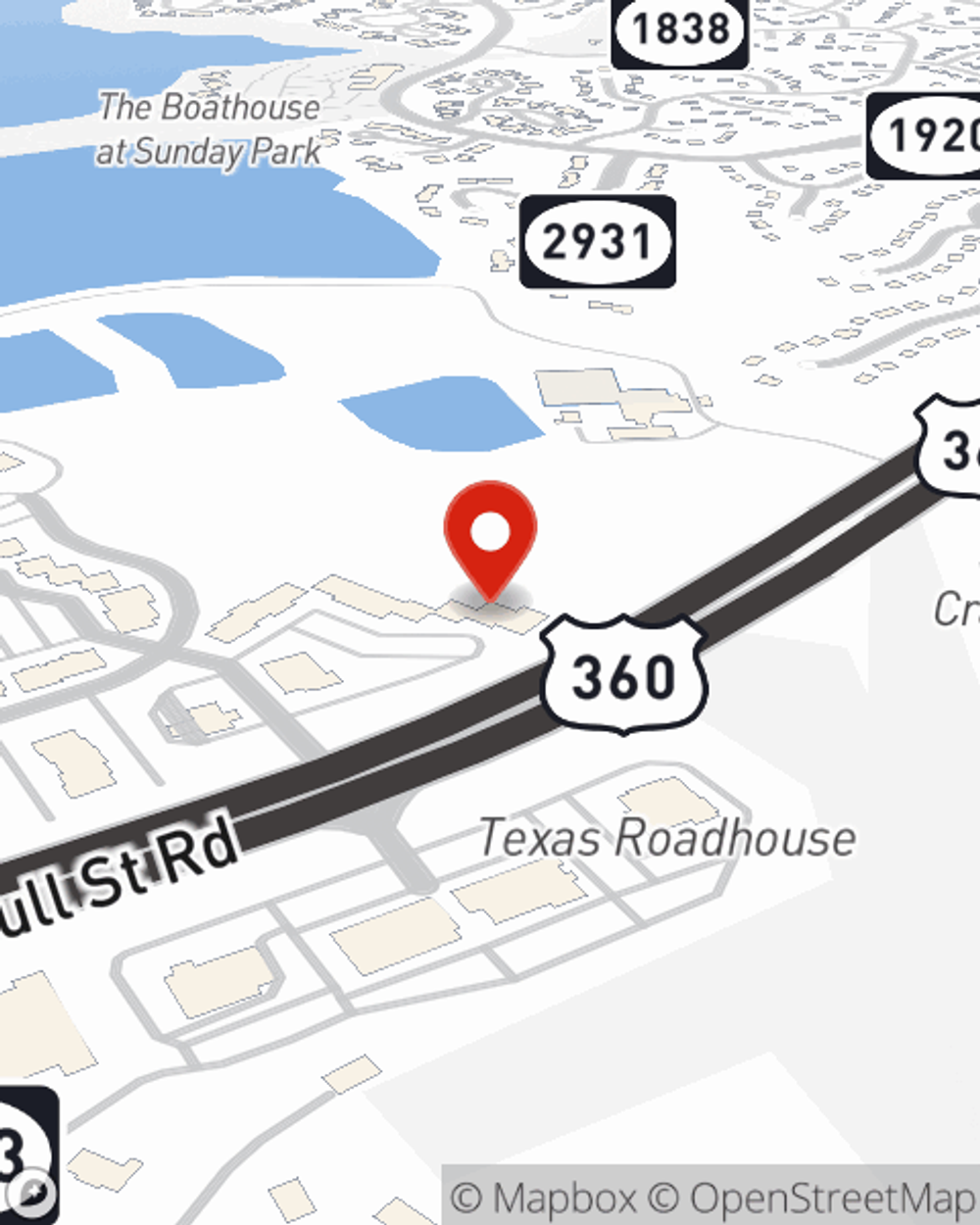

Renters of Midlothian, State Farm is here for all your insurance needs. Get in touch with agent Cindy Shumaker's office to get started on choosing the right policy for your rented property.

Have More Questions About Renters Insurance?

Call Cindy at (804) 739-5600 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Cindy Shumaker

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.